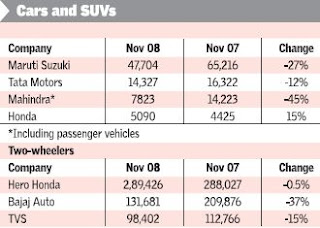

Car & Bike sales crash in November

The reasons behind the 'crash' include consumers tightening their purses, waiting for the year end to pass and not looking to loans as lending norms tighten.

The reasons behind the 'crash' include consumers tightening their purses, waiting for the year end to pass and not looking to loans as lending norms tighten.Almost all car and bike manufacturers have been affected. The one most hit, amongst car brands, is Mahindra Logan which had sales of 300 units in November compared to 1500 units in November, 2007. Wonder if its partly got to do with households shying away from the brand, as its now perceived more as a 'cab'? Me thinks so.

Comments

Your posts are great in terms of knowledge and writing!

I have added your journal in my Blogroll.

--

Best Regards,

Mayuri Palharya (MBA 2003 -05, ABA)

Manager HR - Prestige Group

http://www.mayuripalharya.com/

Long time...

Thank you...for the comments and the Blogroll addition.

Your office at Forum, still? Will drop in... :)

Beautiful pics :)

'Cautiously bullish' seems sensible...

Sure, 'Equity' will have its place in the sun soon...